Agency Conflicts Between Managers and Shareholders

Writers focussed on a disciplinary interest or context such as accounting finance law or management often adopt narrow definitions that appear purpose-specificWriters concerned with regulatory policy in relation to corporate governance practices often use. The SarbanesOxley Act of 2002 is a United States federal law that mandates certain practices in financial record keeping and reporting for corporations.

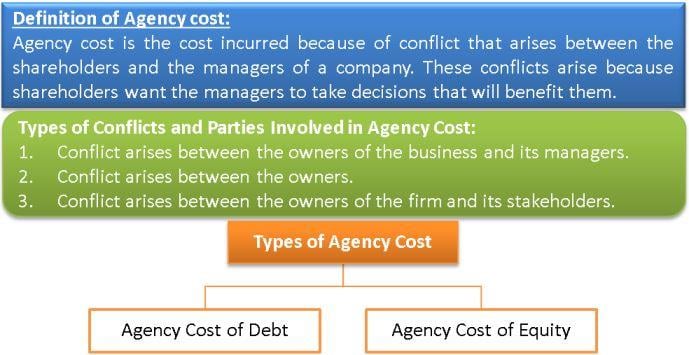

Agency Cost Its Types Viz Equity And Debt How To Reduce It

11 This guidance is to help financial institutions their advisers and Canada Revenue Agency CRA officials with the due diligence and reporting obligations relating to the Canada-United States Enhanced Tax Information Exchange Agreement hereinafter referred to as the Agreement.

. Agency Cost Of Debt. The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. This paper integrates elements from the theory of agency the theory of property rights and the theory of finance to develop a theory of the ownership structure of the firm.

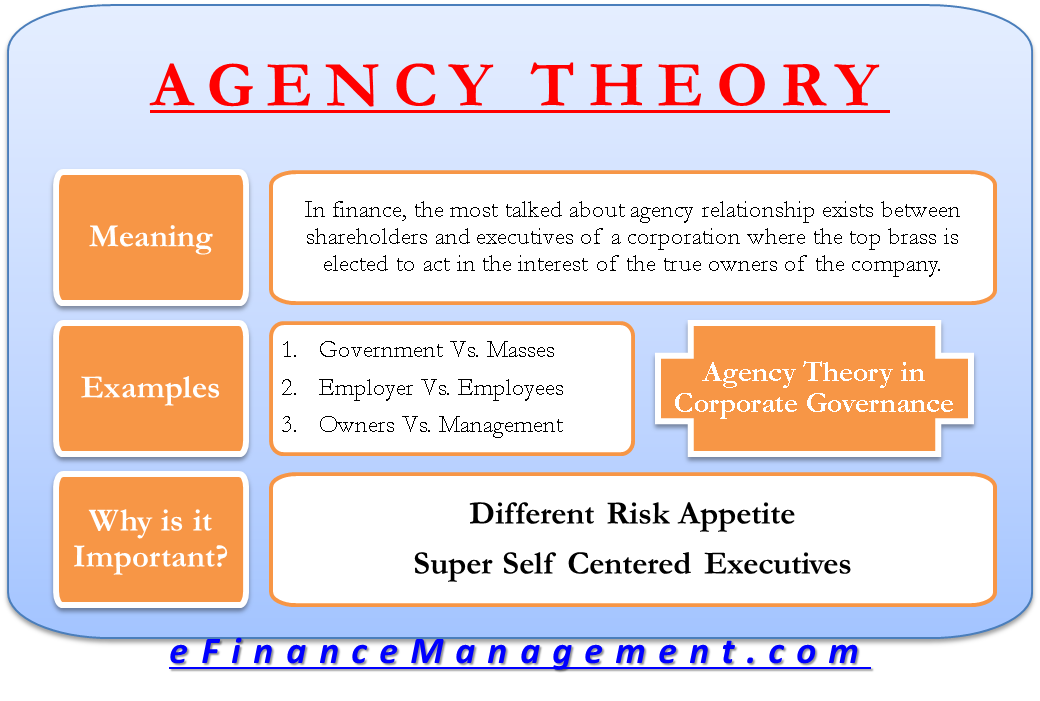

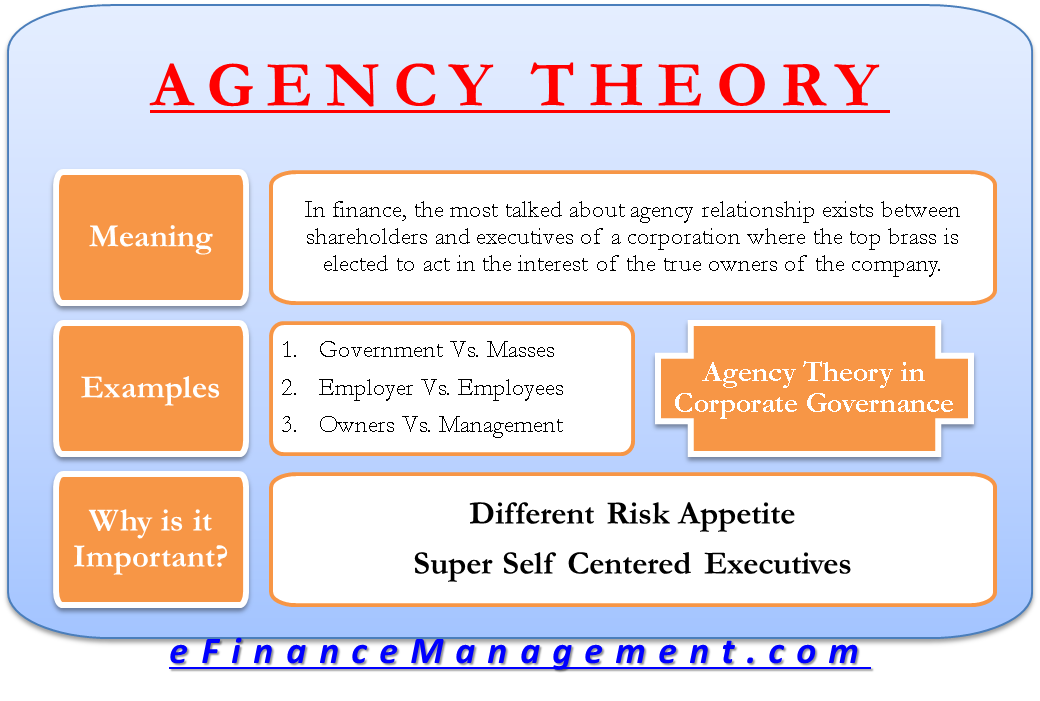

As an example in many tech companies entry-level software engineers are given stock in the company upon being hired thus they become shareholders. Agency theory is based on the idea that when a company is first established its owners are usually also its managers. The agency problem is a conflict of interest inherent in any relationship where one party is expected to act in anothers best interests.

These costs arise because of core problems such as conflicts of interest. Serving the needs of the shareholders as. Since the shareholders approved managers to administer the firms assets a possible difference of interest occurred between the two groups.

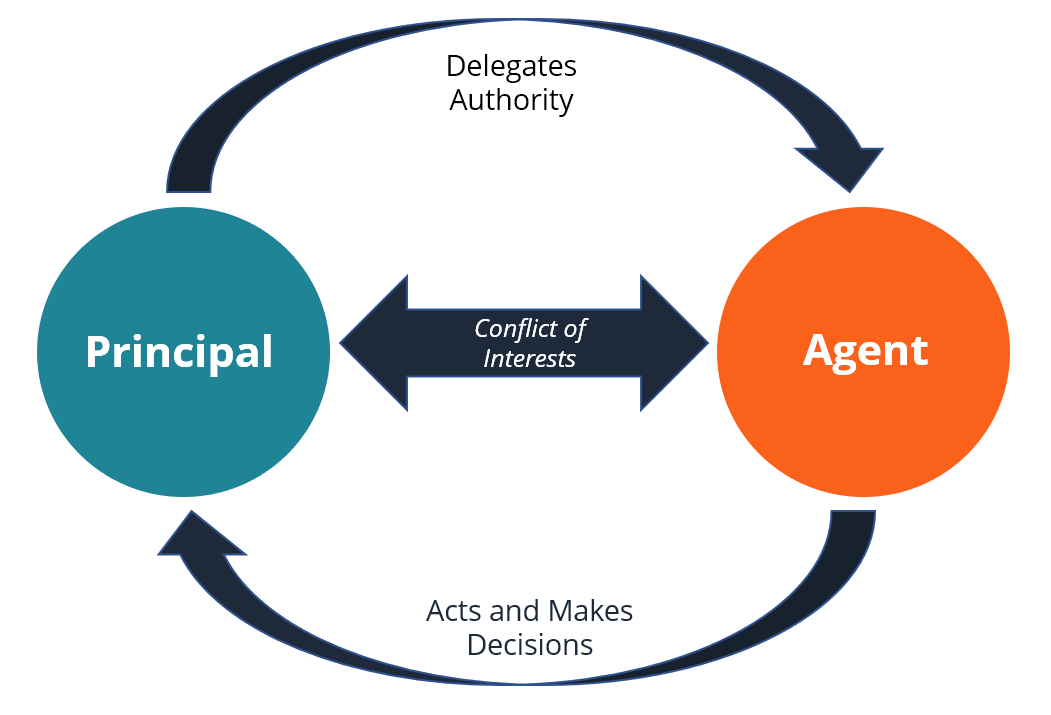

The agency theory examines the duties and conflicts that occur between parties who have an agency relationshipAgency relationships occur when one party the principal employs another party called the agent to perform a task on their behalf. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities. Agency costs are a type of internal cost that arises from or must be paid to an agent acting on behalf of a principal.

It relates to a specific type of agency relationship that exists between the shareholders and directorsmanagement of a company. Course help online is here to help with such urgent orders. Theory of agency deals with the relationship between.

After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning. Mediagazer presents the days must-read media news on a single page. From the production side to the distribution side new technologies are upending the industry.

The shareholders true owners of the corporation as principals elect the executives to act and take decisions on their behalf. Agency theory the anal-ysis of such conflicts is now a major part of the economics literature. 107204 text 116 Stat.

The purpose of this guidance. All you have to do is chat with one of our online agents and get your assignment taken care of with the little remaining time. 745 enacted July 30 2002 also known as the Public Company Accounting Reform and Investor Protection Act in the Senate and Corporate and Auditing Accountability Responsibility and.

A problem arising from the conflict of interested created by the separation of management from ownership the stockholders in a publicly owned company. This problem may occur for example in the governance of the executive power ministries agencies intermunicipal cooperation public-private partnerships and firms with multiple shareholders. Managers are shareholders agents and they will pursue their own objectives.

Agency theory argued that in imperfect capital and labor markets managers were trying to find make best use of their own values without regard for corporate shareholders. Corporate managers are the agents of shareholders a relationship fraught with conflicting interests. Corporate governance is defined described or delineated in diverse ways depending on the writers purpose.

This third-party individual or business entity acts as a point of contact on behalf of the business and receives things like tax forms and legal documents government correspondences and notices of a lawsuit. The payout of cash to shareholders creates major conflicts that have received little attention Payouts to shareholders reduce the resources under. Agency theory in corporate governance is an extension of the agency theory discussed above.

The relationships between investment managers and corporate management is an especially common example of the principalagent relationship. A registered agent essentially acts as the liaison between an LLC and the state its registered in. Copy and paste this code into your website.

Agency theory is often described in terms of the relationships between the various interested parties in the firm. This well-known incentive agency conflict is hardly unique to shareholder-wealth-maximizing organizations. For example incentive problems exist in non.

Being the managers rather of other peoples money than of their own it cannot well be expected that they should watch over it with the same anxious vigilance with. If some shares are given to managers or other employees potential conflicts of interest between employees and shareholders an instance of principalagent problem will be remitted. An agency problem is a conflict of interest between an agent and a principal where an agent is a person or group of people who performs a task on behalf of someone else the principal.

A conflict of interest occurs when one party doesnt fulfill contractual obligations in favor of their own personal or professional interests. The media business is in tumult. Are you torn between assignments and work or other things.

In corporate finance the agency problem. Choose a Registered Agent. The biggest deal came in April 2016 when China Molybdenum a company whose biggest shareholders are a government-owned company and a reclusive billionaire made its 265 billion offer to buy.

We have qualified academic writers who will work on your agent assignment to develop. Any organization regardless of the objective one wishes its managers to pursue encounters incentive conflicts. A comprehensive view of business and entrepreneurial ethics requires an understanding of the difference between shareholders a small group who are the owners or stockholders and stakeholders a large group that includes all those people and organizations with a vested interest in the business.

Principal Agent Problem Overview Examples And Solutions

Resolve The Conflict Between Managers And Shareholders

Agency Theory In Corporate Governance Meaning Example Importance

No comments for "Agency Conflicts Between Managers and Shareholders"

Post a Comment